Commercial Loan Software

This Free Commercial Loan Software Can be Used to Apply to Any Commercial Lender in the Country

Before we go any further, you need to see an example of the finished product - the actual commercial loan application that each lender will see. Please open now and review the Executive Loan Summary below for an imaginary loan of $2.2 million on the ABC Apartments in Sacramento, California.

ABC Apartments Loan - Executive Loan Summary

This four-page Executive Loan Summary can easily be sent by email to dozens of different banks in search of the largest commercial loan, the lowest interest rate, and the longest term.

Now please pay attention. I am about to teach you an important secret to success in commercial real estate finance:

Commercial real estate lenders are extremely fickle and unpredictable. One day a certain bank will love making loans on self storage facilities. The next day, usually after suffering a loss, that same bank wouldn't touch a self storage facility with a ten-foot pole.

Commercial real estate lending is also very subjective. A bank might turn you down because the Wall Street Journal just ran a negative article that week about one of your three retail tenants. This happened to me early in my career, and I lost a huge commission that I really needed.

Commercial lenders - especially banks - can also be very moody. When banks are in a stingy mood, everything looks like a black hair. No commercial loan is good enough. But when a bank is flush with cash, and the Senior Vice President of Loans is under pressure to close some commercial loans, that same bank may overlook a surprising number of flaws. I few years ago I got a bank to approve a deal where the borrower had recently gone bankrupt. On that particular day, the bank needed to make some loans. It was too flush with deposits.

Therefore the key to success in commercial mortgage brokerage is to find the one or two banks out of twenty who are actually in the mood today (it changes every day) to make commercial loans. This handsome Executive Loan Summary of your commercial deal allows you to quickly to present your commercial loan to dozens of different banks.

"But, George, this wasn't what I was looking for. I was looking for some software that helps me fill in a Uniform Commercial Loan Application."

This sounds like an intelligent question. After all, there are dozens of vendors who sell similar software for residential mortgage loan originations.

In real life, however, commercial loan origination software makes little sense. First of all, there is no such thing as a Uniform Commercial Loan Application - similar to the FNMA 1003 residential loan application - used by thousands of commercial lenders across the country. Every commercial lender in the country uses its own commercial loan application.

Secondly, in real life, most commercial lenders don't even ask the borrower to fill out a commercial loan application until the commercial loan has essentially been approved. Huh? Whaaat?

Yup. Completing a commercial loan application is one of the last steps in the commercial loan closing process. Remember, commercial real estate loans are based primarily on the property's cash flow, the value of the property, and the strength of the tenants. The borrower himself is surprisingly unimportant - as long as he has good credit, he has some liquidity, and his net worth is larger than the loan amount. See the Net-Worth-to-Loan-Size Ratio.

When a commercial loan officer for a bank is reviewing a commercial loan package, he might spend ninety minutes studying the appraisal and reviewing the leases. He then might spend only three minutes scanning the borrower's financial statement to verify that the borrower has some liquidity (cash and marketable securities) and a net worth at least as large as the loan amount.

The commercial lender will NOT pour over the borrower's budget to analyze his top and bottom debt ratios. A quick, three-minute scan is all he will do. "Frankly, my dear, I don't give a hoot."

During the commercial loan application process, the bank's commercial real estate loan officer will typically ask for an old financial statement, as well as the actual income and expenses of the property and the leases. Right before he takes the deal to Loan Committee, and only after he has essentially pre-approved the deal, will he ask the borrower to complete an updated financial statement on the bank's forms.

Marsha-Marsha-Marsha. Property-property-property. It's all about the property. Therefore, in order to close commercial real estate loans, a commercial loan broker needs software that showcases the property, not the borrower.

So how do you make a PDF of an Executive Loan Summary that showcases your commercial property?

Where do you go to get access to this wonderful software? And how much does it cost? You will find this software on C-Loans.com, and the cost is... get ready... it's expensive... ready? It's totally free.

"But, George, I have been to C-Loans.com before, and I don't remember ever seeing it."

When you visited C-Loans.com, you probably got distracted by the enticing blue call-to-action ("CTA") buttons on our home page offering a free commercial loan placement kit or a free list of 200 commercial lenders. (The buttons below are not live.)

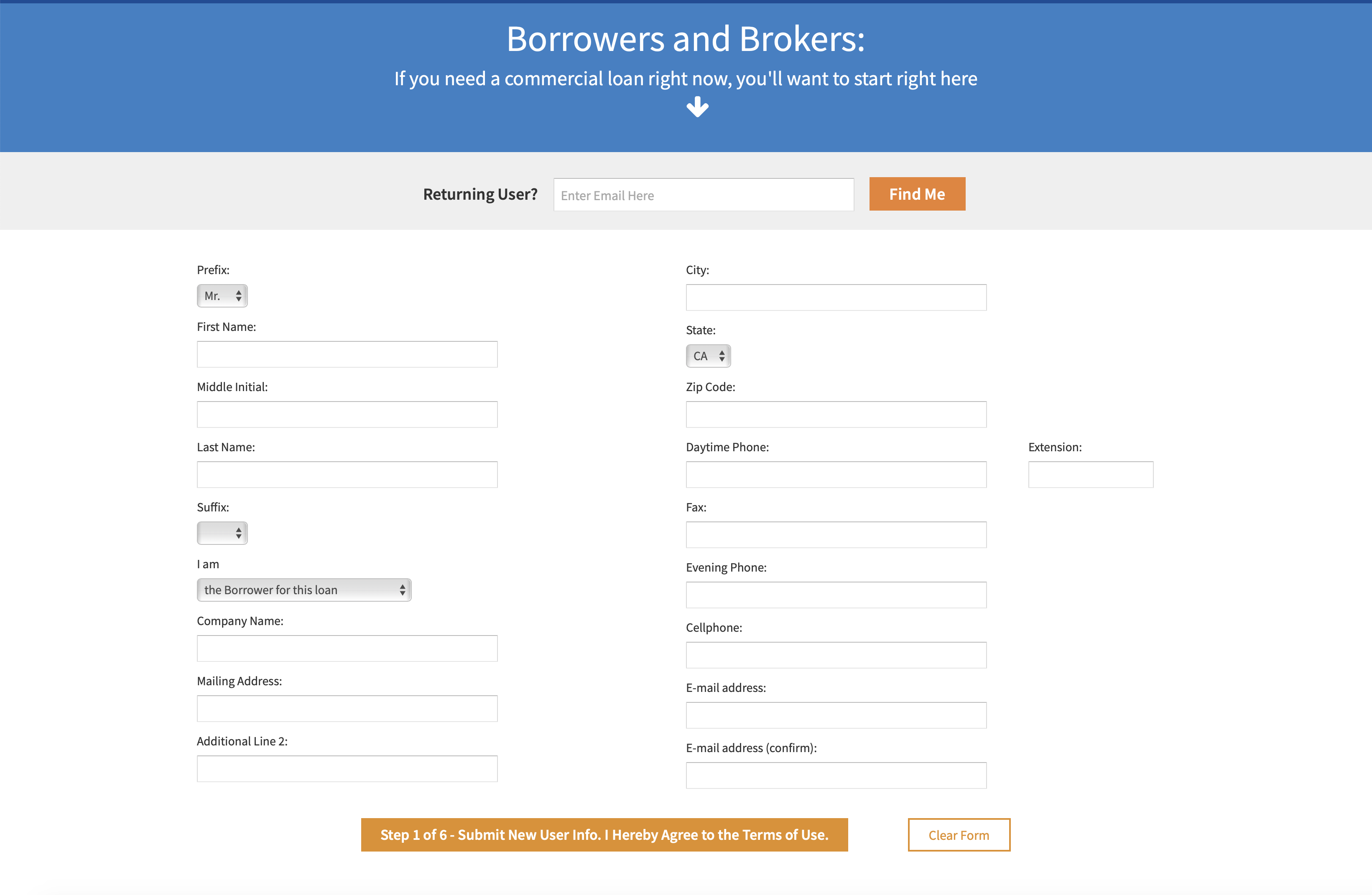

Because you probably got distracted by these CTA buttons, you may have never actually entered a commercial loan into the six-step C-Loans System. Below is the first step:

Had you done so, you could have placed a checkmark next to six lenders and pressed, "Submit". Within minutes, hungry commercial lenders would have been contacting you with offers.

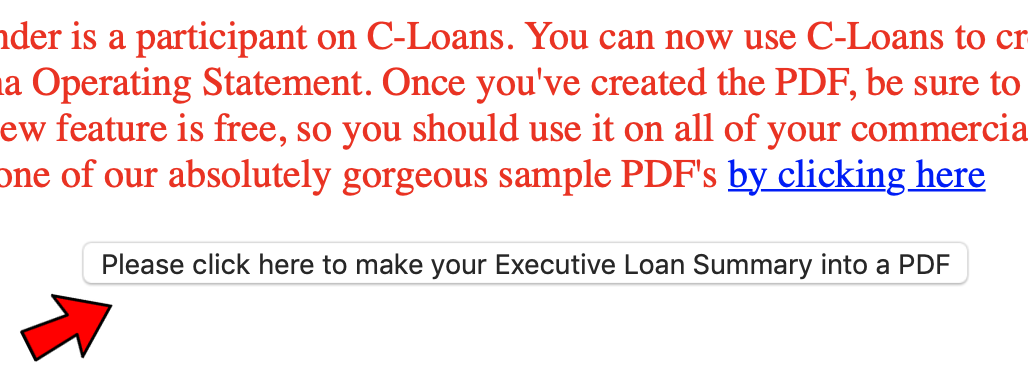

After submitting your commercial loan to six banks, you are given a chance to make your C-Loans app into a PDF:

Voila! It's that simple. Now you have a PDF of your commercial loan package that showcases the property. There was no cost, and perhaps a C-Loans lender will make you an offer that you cannot refuse.