|

To invest, please call Angela Vannucci

at 1-800-606-3232 or CLICK HERE.

|

ROSEBURG MARRIOTT FAIRFIELD INN

George says, "This offering is projected to return in excess of 26% annually, on a simple interest, non-compounding basis. A very experienced hotel builder and developer is building a Fairfield Inn and Suites in Roseburg, Oregon. Still reeling from construction loan losses suffered during the Great Recession, banks today will not exceed 65% loan-to-cost. Therefore, in order to build a roughly $16 million hotel, the developer has to raise over $5.5 million in equity. The Blackburne & Brown Equity Preservation Fund (“EPF”) is endeavoring to raise approximately $2 million.”

“Because this venture is a new construction project, this investment involves substantial risk; however, if you are a wealthy, accredited investor, and you can afford to risk losing your entire investment, you should strongly consider this investment. There are two reasons. First, our developer, my wife’s cousin, is extraordinarily experienced. He has built on the order of 60 hotels from the ground up over the past 23 years. Secondly, this hotel is a cookie-cutter Fairfield In and Suites. The standard nature of these franchise hotels makes them much easier to design and cost. This materially reduces the risk. "

Blackburne & Sons is pleased to present this syndication offering as an equity contributor to the ground-up construction of a NEW Marriott-Fairfield Inn in Roseburg, Oregon. While this type of offering is different from other investment offerings in the past, the past performance and experience of the developer and the Marriott flagship caught the attention of Blackburne & Sons as an opportunity for our investors.

The return on this investment will come from two ways:

- Cash distributions from operating income, after construction completion, estimated to be in 2020.

- Gain on sale, after stabilized.

No income will be generated during construction and early start-up; therefore distributions from cash-flow are not forecasted to begin sooner than 18 months after the initiation of this investment. More on the cash-flow and distributions later in this offering.

Fairfield Inn is the second largest Marriott International brand, and the franchise is stated to be a proven performer poised for growth. Per the Fairfield Inn proposal, the current prototype is designed to deliver flexibility, whether the hotel is located in an urban, secondary or tertiary market. Franchise Hotel Performance, per Marriott, shows an average occupancy rate of 69.9% for their hotels and an average daily rate of $110.83. Key competitors are Hampton Inn, Holiday Inn Express and La Quinta.

The franchise brand is now celebrating 30 years in existence, and it boasts over 900 hotels worldwide. Fairfield Inn’s offer complimentary breakfasts, a “Corner Market” offering healthy grab and go items, a 600+SF fitness room and indoor/outdoor pool. Fairfield Inns also accept Marriott Rewards Members and allow members to redeem their benefits at other Marriott hotels.

Construction of the subject property has yet to commence. The sponsors/developers of this project are in the midst of obtaining the equity required to secure the desired construction financing, and subsequent take-out loan after construction is complete. The equity piece of the capital stack will be comprised of (1) the sponsors (more on them below), (2) Blackburne & Brown Equity Preservation Fund - Class 2019-02 (“EPF”), and (3) other investor(s) still to be determined.

Quick housekeeping matter: The Equity Preservation Fund is not a fund; rather it is a special Delaware master limited liability company. We have been using it for about 13 years. Drafting new LLC paperwork every time you create a new LLC involves an attorney, and it is expensive. Delaware allows sponsors like us to create a single master limited liability company, with a different class for each investment. Each class has all of the protections of a limited liability company, and it is financially-insulated from all other classes. One class could win the lottery, and another class could go bankrupt, and the creditors and investors of other classes cannot “jump the fence”. While our investors save some serious money on organizational costs, the State of Delaware still requires a franchise fee of around $800 per year from each class. It’s why they offer this special kind of LLC. Lastly, the name Blackburne & Brown Equity Preservation Fund was created originally to bring equity into over-leveraged properties, but the concept never caught fire. Investments in the Equity Preservation Fund do NOT go into a fund, and despite the name, there is no guarantee that your equity will, in fact, be preserved.

Back to the offering: Once the equity is secured, construction financing will be obtained. A lender has been conditionally secured, pending completion and approval of due diligence reports, as well approval of applicable permits and licenses. The initial review process of the loan has been approved by the loan committee, and due diligence reports are on track to submit for final lender approval by the end of April, 2019. Current terms of the financing offered is a 6.50% rate on the construction piece and 5.50% on the permanent financing. The first six-months of the construction loan will be interest-only payments. Payments thereafter, will be principal and interest payments until the loan is paid in full, which is projected to be in 2025 at the time the property is sold. Note that the FF&Es are included as hard costs in the construction budget and will not be financed, but purchased with the equity raised. Title to the property will be in the name of a newly formed limited liability company, Boulder5, LLC, an Oregon limited liability company. The members of Boulder5, LLC will include the two sponsors, the EPF and the other TBD investor(s). Ownership percentage in this LLC will mirror the capital contributions. An agreement between the members will exist to where repayment of each member’s capital will be outlined, along with provisions in the case of default.

Contrary to the capital contributions mirroring the ownership, distributions of cash-flow and net sale proceeds are allocated to 43% to the sponsors and 57% to the equity partners, i.e. EPF and TBD investors. This additional percentage to the sponsors is included for the sponsors liability associated with the personal guarantee required for the financing of the project, and the additional equity from each sponsor. The distribution structure of income will only come into play if EPF and TBD investors do not earn at least an annualized yield of 10% each year. For example, if in Year 2 the profits result in a 9% yield to EPF investors, the sponsors will reduce their distribution share (not to go below their 36% equity contribution). The sponsors state they are confident this provision is only a formality, as their projections (which sponsors state to be conservative) exceed the 10% annualized return each year. See CASH FLOW PROJECTIONS AFTER CONSTRUCTION in Section titled PRESENTATION OF OFFERING in your updated due diligence package dated March 19, 2019.

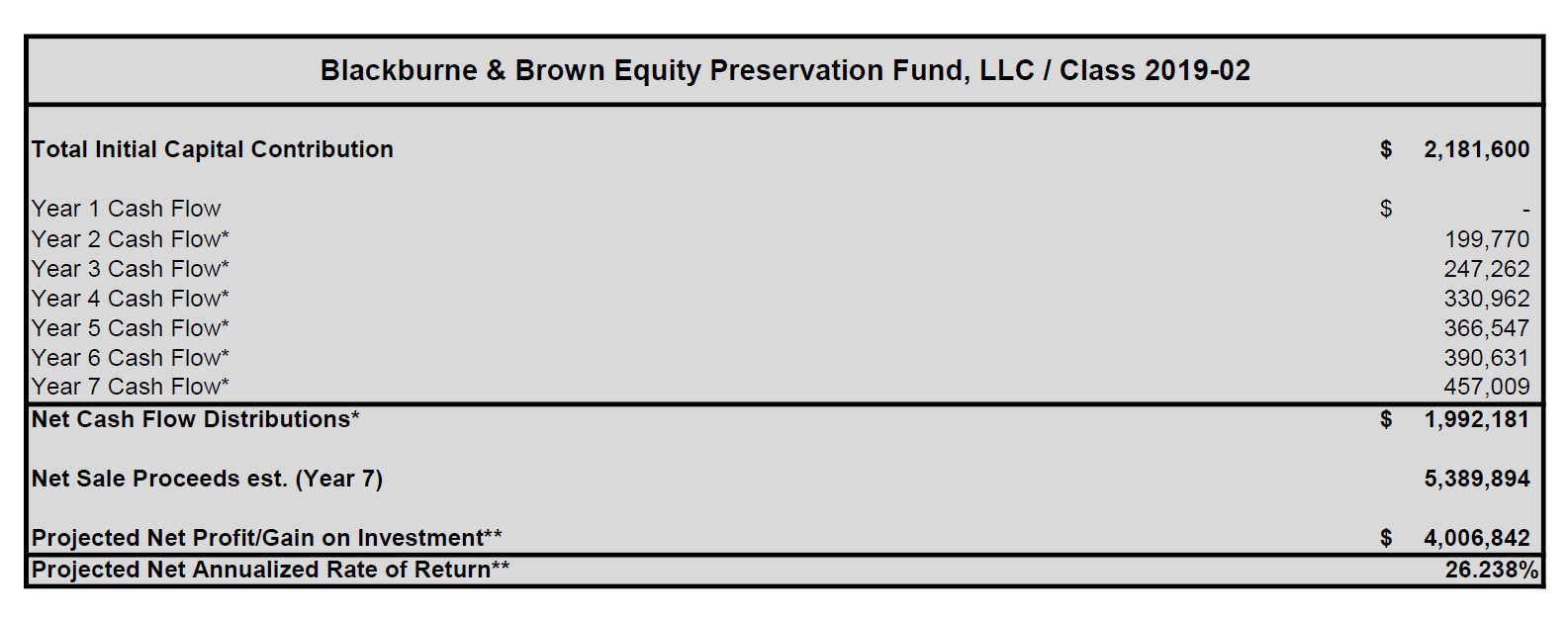

Per the updated construction budget and revised projections based on the conditional loan terms outlined above, the flow of distributions and return to the EPF may look like the following:

NOTE: The above is based on projections provided by the sponsors and were not confirmed by independent consultants. Additional costs will almost certainly be discovered as we approach the funding of the construction loan, but the final cost numbers should be reasonably close to the above because our builder-developer has unusual experience building franchise hotels.

In short, the plan for this project is to build, hold, operate for several years to reach stabilization, and then to sell. Per the sponsors, “REIT’s LOVE Marriott branded properties so they are the first go to on exit.” Projections reflect a sale in 2025 and assume a 9% cap rate, which reportedly a conservative cap rate for this type of property.

As for the franchise agreement with Marriott, the agreement is 20 years and is transferable to a new owner subject to Marriott’s approval.

While the plan and projections are important in an offering this of kind, experience arguably is equally important, if not more. The first sponsor, Alex Jensen, brings the construction experience to this deal. He has experience in constructing in excess of 60 ground-up hotels throughout the country over his 23 year span in the construction industry. (Think about that - 60 hotels. Impressive.) Historically it has been Mr. Jansen’s business to build franchise hotels, as the general contractor, for other developers. Three years ago, Mr. Jansen finally started building hotels for his own account. He developed a Residence Inn by Marriott in Hillsboro, Oregon. This was a 146 room property that opened in July 2016, this very successful venture produced an IRR of excess of 30%. Here is a link to Jensen’s bio, http://www.blackburneandsons.com/AlexJansenBio.png.

Day-to-day operations will be handled by Harish Patel, who currently resides in Portland, Oregon. Mr. Patel is experienced in site selection, land acquisition, permit processes, financing, and budgeting and project management. He has been approved by Marriott to manage the property, which in and of itself is a rigorous process, as we are told. Here is a link to his bio http://www.blackburneandsons.com/HarishPatelBio.png.

Below is a more detailed list of what Patel has developed/owned/managed:

Hotels Managed thus far:

Hampton Inns, full-service Holiday Inn, Holiday Inn Express, full-service Best Western Inn & Suites, full-service Ramada Inn, Comfort Inn Quality Inn & Suites, Travelodge, Shilo Inn, and Independents.

Ground-Up Brands Developed:

Hampton Inns, Best Western Inn & Suites, and Holiday Inn Express (First in the system in Oregon, 1992)

Conversions:

Independents to Full Service Holiday Inn, Comfort Inn, Ramada Inn, Quality Inn & Suites and Travelodge. The state of Oregon has enjoyed strong economic growth in recent years. Roseburg has a population of 22,275, and it is 123 miles north of the California border and 67 miles south of Eugene (the state’s 2nd largest city). The proposed site of the new Fairfield Inn and Suites will be located alongside major Interstate 5, that travels not only through Oregon, but through California as well.

The state of Oregon has enjoyed strong economic growth in recent years. Roseburg has a population of 22,275, and it is 123 miles north of the California border and 67 miles south of Eugene (the state’s 2nd largest city). Our new Fairfield Inn and Suites will be located adjacent to Interstate 5, which runs north and south from Canada to Mexico. The traffic count at this location averaged 34,500 cars when last surveyed in 2016. Roseburg lies at the intersection of I-5 and Highway 42, which will take you to the Oregon coast, and Highway 138, which will take you to Bend and eastern Oregon. For more information on Roseburg's economic development, please check out this video.

|

To invest, please call Angela Vannucci

at 1-800-606-3232 or CLICK HERE.

|

RISK FACTORS

Any new construction project involves substantial risk, and the list of risks is so extensive that we have attached it as an addendum here. www.blackburneandsons.com/pdf/AdditionalRisksofConstruction.pdf Please be sure to study these risk factors carefully before choosing to invest.

FOOTNOTES:

1. The property information contained in this Property Investment Bulletin is being provided in connection with an offering of membership interest units ("Units") by Equity Preservation Fund, LLC (the "Company") in the membership class designated above (the "Company Class"). Potential investors will purchase membership interests in the Company Class which will, in turn, hold title to the Investment Property. Units are offered only to verified accredited investors pursuant to the Company's Private Placement Memorandum dated May 9, 2017. ("Memorandum"). Potential investors should read the Memorandum and all of the exhibits thereto in their entirety prior to investing.

2. This Property Investment Bulletin contains forward-looking statements within the meaning of federal securities law. Words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “continue,” “predict,” or other similar words, identify forward-looking statements. Forward-looking statements include statements regarding the Manager’s intent, belief or current expectation about, among other things, trends affecting the economy and the market in which the property is located. Although the Manager believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including those set forth in the “Risk Factors” section of this Memorandum. If any of the events described in “Risk Factors” occur, they could have an adverse effect on the Fund’s business, financial condition and results of operations. When considering forward-looking statements, prospective investors should keep these Risk Factors in mind as well as the other cautionary statements in this Memorandum. Prospective investors should not place undue reliance on any forward-looking statement.

Blackburne & Sons Realty Capital Corporation--For more information, contact Angela Vannucci

4811 Chippendale Drive, Suite 101, Sacramento, CA 95841

Telephone: (916) 338-3232 * Fax: (916) 338-2328

Real Estate Broker -- California Bureau of Real Estate -- License Number 829677

Offering issued with reliance upon exemption provided under section 4(a)(2) of the Securities Act of 1933

and Rule 506(c) of Regulation D.

Return to C-Loans Home Page | Return to Blackburne & Sons Home Page

Copyright © 2019 Blackburne & Sons Realty Capital Corporation. All rights reserved. (800) 606-3232

|