C-LOANS BANKER LETTER

This letter is intended only for commercial mortgage loan officers working for banks and hard money lenders. Today we'll talk about 24-hour cities. And, of course, because this is C-Loans (the jokesters), we have lots of cute, clean jokes, some funny pics, and a delightful video with a couple lip-syncing love songs of the decades. I promise that it will make you grin and grin.

Joke Du Jour

After three years of marriage, Kim was still questioning her husband about his lurid past. "C'mon, tell me," she asked for the thousandth time, "How many women have you slept with?" "Baby," he protested, "if I told you, you'd throw a fit". Kim promised she wouldn't get angry and finally convinced her hubby to tell her. "Okay," he said, "One, two, three, four, five, six, seven - then there's you - nine, ten, 11, 12, 13..."

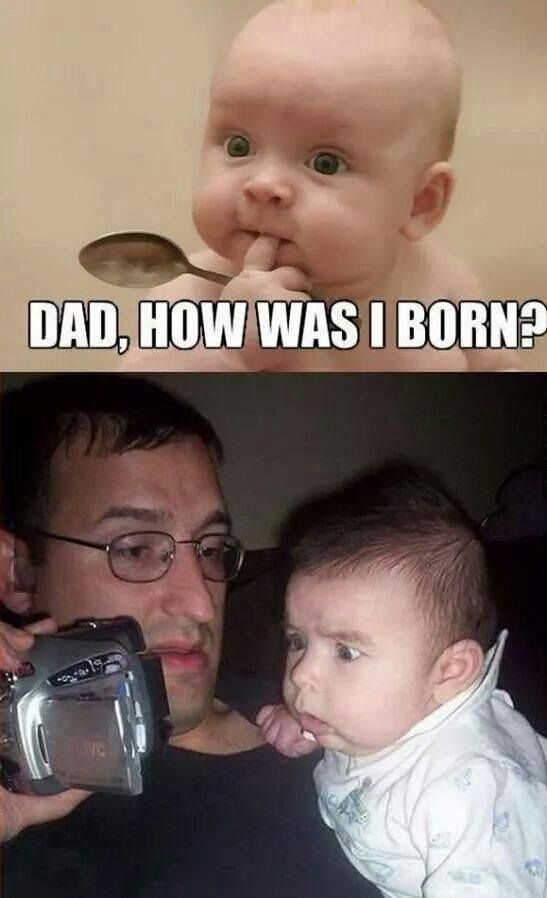

I Crawled Out of Where?

Ever Wonder What a C-Loans Application Looks Like?

Here's a sample commercial loan application.

Hamsters Joke

Bought the missus a hamster-skin coat last week. We went to the fair last night, and it took me three hours to get her off the Ferris Wheel. (No sweet little hamsters were hurt in the making of this joke.)

Please Refer Your Commercial Loan Turndowns to Either CommercialMortgage.com or C-Loans.com

If you turn down a commercial real estate loan this week, would you kindly refer the borrower to CommercialMortgage.com (probably an easier web site name to remember) or C-Loans.com? CommercialMortgage.com sure better be easier to remember! We paid $100,000 just for that domain name. If none of our 4,000 different commercial lenders can help him, the deal probably isn't do-able. Thanks so much!

LSD Joke (PG)

A teenage boy asks his granny, "Have you seen my pills? They were labeled LSD?" Granny replies, "To hell with the pills, did you see the dragons in the kitchen?"

What is a 24-Hour City?

I was speaking with a big commercial lender this week. His minimum loan is $5 million! Anyway, he mentioned that he only lends in 24-hour cities. Hmm. What exactly is a 24-hour city?

A 24-hour city is defined as a city that never sleeps - restaurants, shops, and even movie theaters stay open all night. Examples of 24-hour cities include New York City, San Francisco, and Las Vegas.

What's so special about 24-hour cities? "Twenty-four-hour markets have attracted and retained businesses (and even spurred startups) so successfully that their CBD office vacancy rate averaged just 10.3% (between 2001 and 2014)... During the same stretch, the downtowns of 9-to-5 cities averaged a 16.6% office vacancy rate."

Comparable properties in 24-hour cities are much, much more expensive to lease or buy than in 9-to-5 cities. You would think that some shrewd business owners would spot the arbitrage. Why move to New York City when comparable office space in Columbus, Ohio is 60% cheaper, right? Over time you would think that the difference in lease rates and property values would shrink because of the increased demand for Columbus office space, right? Nope.

Just the opposite has happened. "Between 2001 and 2014, sales prices for office properties in 24-hour cities were 72 percent higher per square foot than those in 9-to-5 cities... No shock there. But despite those higher prices, the cumulative total return for property in 24-hour CBDs since 1987 has been an astounding 152 percent greater than for 9-to-5 downtowns..."

Put in simpler terms, while an investor may have to pay a boatload more for a 24-hour city (NYC) property, the return on his money is MUCH higher than investments in 9-5 cities! Wow. Its no wonder that the Big Dogs prefer to lend in 24-hour cities.

I Want Some Cotton Candy, and I Want It Now!

Getting Hungry For Commercial Loans Again?

As a lender, should you join C-Loans.com or the faster, easier portal, CommercialMortgage.com? It depends. If you'd like to close an extra couple of commercial loans every year, you should probably just join CommercialMortgage.com. If you are serious about expanding your commercial lending division, however, you should definitely join C-Loans.com. You will get far more applications.

Breakfast Joke

I woke up this morning at 11:30 and could sense that something was wrong. I got downstairs and found the wife face down on the kitchen floor, not breathing! I panicked. I didn't know what to do. Then I remembered McDonalds now serves breakfast all day.

Bankers: Get 200 Free SBA Loan Applications

Does your bank want to close more SBA loans? C-Loans.com will give you two hundred SBA loan leads for free, deals that are perfect for your bank. These loans will be the right size. They will be located only in your favorite counties of your favorite states, and these SBA loans leads will be secured by just the type of commercial real estate that you prefer - office buildings, industrial buildings, etc.

Please click here for more information about how to receive 200 free SBA loan applications. The above offer is made only to commercial banks and credit unions.

What if you don't work for a bank or credit union, but your commercial mortgage company services more than $20 million in commercial real estate loans? We have a fine program for you too. Please call Tom Blackburne at (574) 210-6686 or click here for more details.

Building a Car Joke

Fred was telling his friend how his uncle tried to make a new car for himself... "so he took wheels from a Cadillac, a radiator from a Ford, some tires and fenders from a Plymouth..." "Holy Cow," interrupted his friend, "What did he end up with?" And Fred replied, "Two years."

Free Commercial Mortgage Marketing Course

You've got a buddy who works as a commercial loan officer at a neighboring bank, right? We'll trade you the contents of one of his or her business cards for a free commercial mortgage marketing course. We sell this popular course separately on C-Loans.com for $199. Learn how to turn on a flow of SBA and conventional commercial mortgage leads as easily as turning on a spigot.

Important note: This has nothing to do with joining C-Loans as a lender. For more information, please click here.

Golf Truisms

Never wash your ball on the tee of a water hole.

Nothing straightens out a nasty slice quicker than a sharp dog-leg to the right.

Always limp with the same leg for the whole round. Ha-ha!

Join C-Loans For a Flat Fee

Most banks that join C-Loans take advantage of our free guaranteed success program; but a bank can now join C-Loans, get listed on our Suggested Lender Lists, and receive tons of commercial mortgage loan applications for a small monthly fee:

For banks with less than $2 billion in assets, the cost is just $250 per month, and up to three loan officers can receive our SBA and commercial real estate loan leads.

For banks with more than $2 billion in assets and less than $7 billion in assets, the cost is just $350 per month, and up to four loan officers can receive our SBA and commercial real estate loan leads.

For banks with more than $7 billion in assets and less than $15 billion in assets, the cost is just $500 per month, and up to five loan officers can receive our SBA and commercial real estate loan leads.

For banks with more than $15 billion in assets, the cost is just $1,000 per month, and up to ten loan officers can receive our SBA and commercial real estate loan leads.

Important note: In all of these cases, the bank owes nothing more, even if it closes a loan.

To join C-Loans using our new flat-fee program, please email Tom Blackburne, General Manager, or call him at 574-210-6686.

But, once again, most banks joining C-Loans, take advantage of our free guaranteed success program, where the bank only pays C-Loans, Inc. a software licensing fee of 0.375 points (just 25 bps. on deals over $5MM) if it closes a commercial loan from C-Loans. Most banks simply increase their normal loan origination fee from 1.0 point to 1.375 points to cover the cost of using our software and receiving our leads. This makes C-Loans effectively free to the bank.

To join using our guaranteed success program - effectively free to the bank - simply use this super-easy form to join C-Loans as a lender.

Wheelchair Joke

Seven wheelchair athletes have been banned from the Para-Olympics after they tested positive for WD40.

Referring Your Turndowns to C-Loans.com (or CommercialMortgage.com) Gives Your Customers a Good Place to Look

If you have to turn down a bank customer's request for a commercial loan, it will help him if you could suggest a place for him to look elsewhere. With 750 different commercial real estate lenders participating on C-Loans.com, if your customer can't qualify for a commercial mortgage from us, he probably won't qualify anywhere. Thank you so much!

Alligator Teeth Joke

A tourist was admiring the necklace worn by a local Indian. "What is it made of?" she asked. "Alligator's teeth," the Indian replied. "I suppose," she said patronizingly, "that they are about as precious to you as pearls are to us." "Oh, no," he objected. "Anybody can open an oyster."

How To Close Investor Commercial Loans When Your Loan Committee Won't Exceed 62% LTV

Suppose one of your better bank customers wants to buy a commercial building, not for his company, but rather just for investment. The deal cash flows perfectly at 75% LTV, but your nervous Loan Committee cuts the deal back to just 62% LTV. "Gosh, I have been a good bank customer for decades. I thought my own bank would take better care of me."

The sister company of C-Loans, Blackburne & Sons, raises small balance JV equity for such deals, and we'll raise as little as $100,000. We'll add our equity to your customer's down payment to create a down payment large enough to satisfy your Loan Committee.

Got a potential deal? Please complete this simple preferred equity application or call Angela Vannucci at 916-338-3232.

Ain't It the Truth?

Elks Joke (PG-13)

Two Norwegians are drinking in a bar. One says to the other, "Did you know that Elks have (marital relations) 10 to 15 times a day?" "Aww, (poop)!" says his friend, "and I just joined the Knights of Columbus!"

Would You Mind a $21,250 Referral Fee?

We once paid a $21,250 referral fee to a website owner named Alan Dunn of Spydercube.com for referring us a $17 million deal. Not long ago we paid our friends at RealWebFunds.com an $11,000 referral fee.

We've made it super-easy to refer us commercial loans and to receive big referral fees. Please click here for details.

Video - Lip Syncing Couple Sings the Love Songs of the Decades - You Will Grin and Grin!

I dare you not to smile.

Blue Joke (PG-13)

A week after their marriage, the redneck newlyweds, Ed and Wanda, paid a visit to their doctor. "You ain't gonna believe this, Doc," said Ed. "My thingy's turnin' blue." "That's pretty unusual," said the doctor. "Let me examine you." The doctor took a look. Sure enough, Ed's "thingy" really was blue. The doctor turned to Wanda and asked, "Are you using the diaphragm that I prescribed for you?" "Yep, shore am," she replied brightly. "And what kind of jelly are you using with it?" "Grape," she replied.

CommercialMortgage.com Really Is Free For Banks To Join

Stop! This has nothing to do with joining C-Loans.com. This is a totally different portal with totally different rules.

You can list your bank on CommercialMortgage.com in just four minutes for free. There is no set-up charge. There is no monthly fee. You don't even owe a fee if you close a deal. Unlike C-Loans.com, your listing is truly 100% free.

Your bank could surely stand to make a few more commercial loans. You would be absolutely nuts not to add your bank to this very active new portal (1,100 commercial loan app's in the first three weeks). Please click here to add your bank to CommercialMortgage.com.

Are you confused as to how C-Loans, Inc. could afford to spend $250,000 creating a new commercial mortgage portal that competes against its own flagship site, C-Loans.com? How can we afford to provide this site for free to both the borrowers and bankers?

The Blackburne family of commercial mortgage companies (est. 1980) also includes Blackburne & Sons Realty Capital Corporation. This hard money commercial mortgage company makes 15 year commercial loans nationwide using the funds of our 1,500 private investors. We earn a 2% loan servicing fee (200 bps!) on these loans, so if a loan stays outstanding for 15 years, we earn 33 points, including our typical 3-point origination fee. That's $330,000 in gross profit on a hard money loan of just $1 million.

By creating this free new portal, we get to look at every commercial loan that enters CommercialMortgage.com. Picture us as a grizzly bear, knee deep in the river, during salmon spawning season. So take your free listing on CommercialMortgage.com and run. Our new portal really is 100% free to your bank.

Final Funny

An elderly couple, who were childhood sweethearts, had married and settled down in their old neighborhood. To celebrate their 50th wedding anniversary, they walked down to their old school. There they hold hands, as they find the desk they shared and where he had carved, "I love you, Sally."

On their way back home, a bag of money falls out of an armoured car practically at their feet. She quickly picks it up. They don't know what to do with it, so they take it home. There she counts the money, $50,000. The husband says, "We've got to give it back." She says, "Finders keepers." She puts the money back in the bag and hides it up in their attic.

The next day, two FBI men are going from door-to-door in the neighbourhood looking for the money, and they show up at their home. One knocks on the door and says, "Pardon me, but did either of you find any money that fell out of an armoured car yesterday?" Sally says, "No." The husband says, "She's lying. She hid it up in the attic." She counters, "Don't believe him, he's getting senile."

But the agents sit the old man down and begin to question him. One says, "Tell us the story from the beginning." The old man says, "Well, when Sally and I were walking home from school yesterday..." At this point, the FBI guy looks at his partner and says, "We're outta here!"

One Final Pathetic Plea

If you won't let us pay you a referral fee, won't you please-please refer your commercial mortgage turndowns to C-Loans.com or to CommercialMortgage.com? Thanks!

|